About Stakeborg and Stakeborg DAO

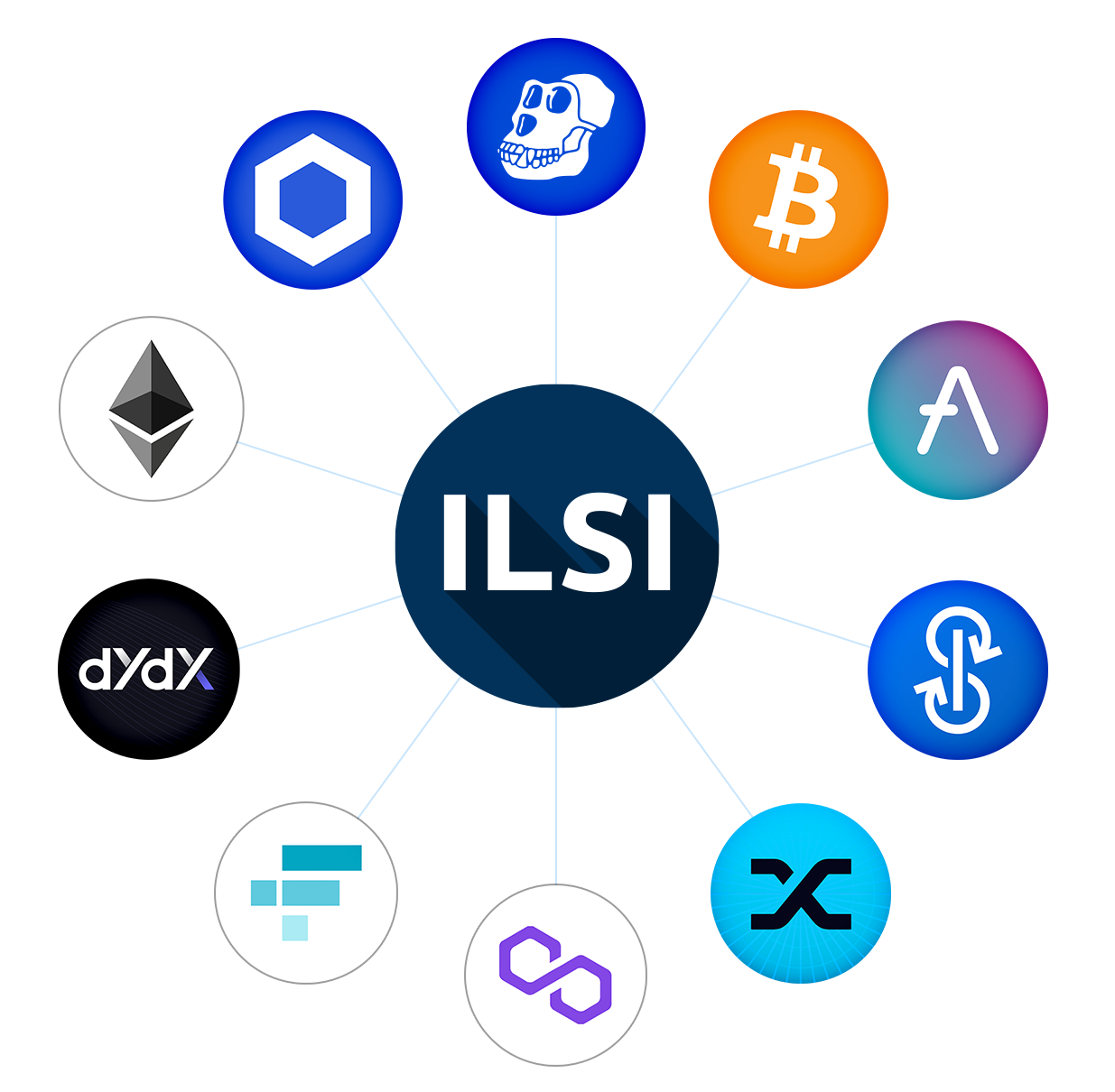

Stakeborg is a leading crypto hub focused on increasing the adoption of blockchain and crypto at all levels through education, community building, media and consulting activities. Stakeborg has been at the forefront of the nascent DAO industry by establishing the Stakeborg DAO community. Fees related to Stakeborg-sponsored indexes will be wired to the DAO treasury.

Investors opting for a mixed strategy, with allocations in both Stakeborg-sponsored indexes and Stakeborg DAO $STANDARD token, would be part of the whole Web 3.0 eco-system driven by the DAO community.